Stock option value calculator

Free Option Calculator based on Black-Scholes with Call and Put Prices Greeks and Implied Volatility Calculation. Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0 20 Days.

European Option Definition Examples Pricing Formula With Calculations

The Profit at expiry is the value less the premium initially paid for the option.

. My startup stock options calculator Real Finance Guy RFG Stock Option ISO Value Estimator Number of Shares in Grant Current Value Per Share Total Number of Shares. According to the calculator at the end of five years 500 shares of stock will be worth 13224. The Black Scholes option calculator will give you the call option price and the put option price as 6567 and 930 respectively.

The formula below shows that time value is derived by subtracting an options intrinsic value from the option premium. On this page is an Incentive Stock Options or ISO calculator. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

Subtracting the 10000 it would cost to exercise the options shows a pre-tax. With SAMCO your brokerage will be Rs20 for the entire order. The data and results will not be saved and do not feed the tools on this.

This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies. Black-Scholes Calculator To calculate a basic Black-Scholes value for your stock options fill in the fields below. To put it simply say you buy 20 lots of call options on the NIFTY in one order.

Time Value Option Price-Intrinsic Value T ime V. We pull financial information on the company you entered from Finnhub. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options.

Option value calculator Calculate your options value. An call options Value at expiry is the amount the underlying stock price exceeds the strike price. Lets say we have a call option on IBM stock with a price.

Options involve risk and are not suitable for all investors. Stock Option Tax Calculator Calculate the costs to exercise your stock options - including taxes. We calculate the volatility of that company using the share price data.

AMT Calculator Exercise incentive stock options without paying the alternative. Assumptions and limitations of the Black. You can calculate your savings with the Brokerage.

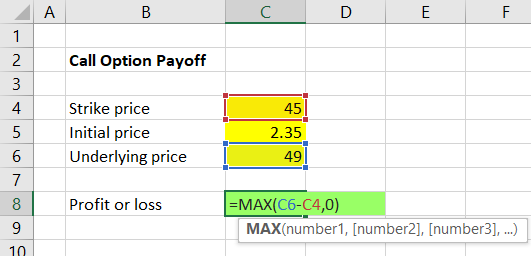

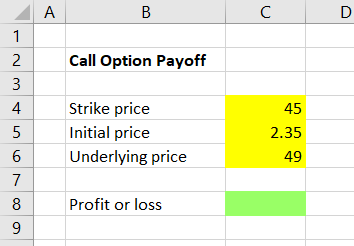

Calculating Call And Put Option Payoff In Excel Macroption

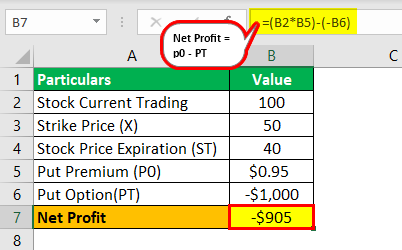

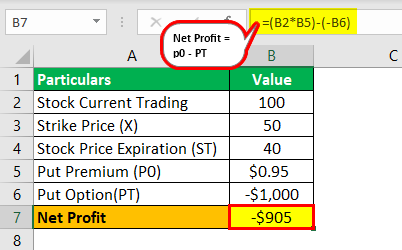

Put Options Definition Types Steps To Calculate Payoff With Examples

Theta Varsity By Zerodha

Employee Stock Options Financial Edge

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

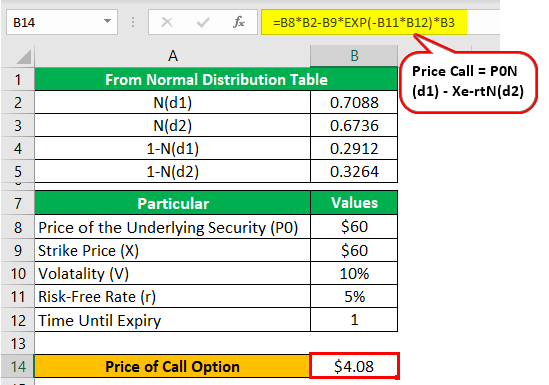

Option Pricing Models Formula Calculation

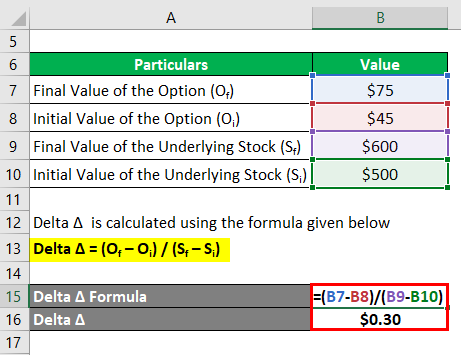

Delta Formula Calculator Examples With Excel Template

Employee Stock Options Financial Edge

Calculating Call And Put Option Payoff In Excel Macroption

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Treasury Stock Method Tsm Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Understanding The Binomial Option Pricing Model

Treasury Stock Method Tsm Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

What Is An Employee Stock Option Eso

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Treasury Stock Method Tsm Formula And Calculator Excel Template

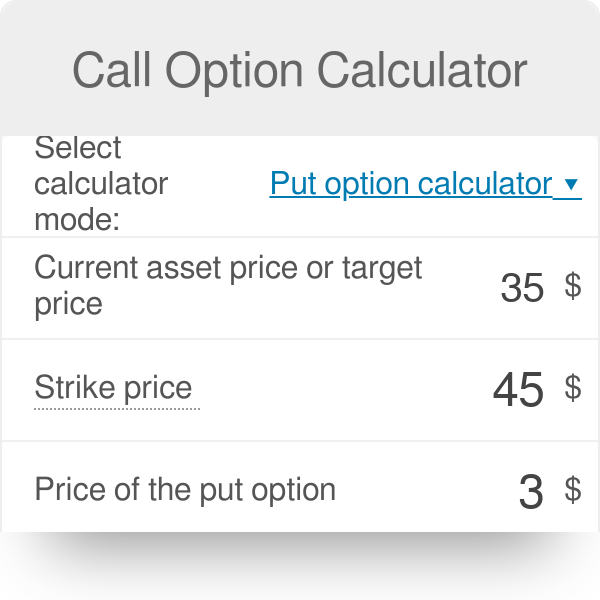

Call Option Calculator Put Option